In this article, we will discuss the Final Expense Insurance for seniors in detail so that you can make the right choice!

Final Expense Insurance is one of the most reliable ways for family care after your death. But deciding which policy is right for you can be challenging.

This article will answer these questions in detail:

- How does the senior care plan life insurance best for seniors ?

- What is the best life insurance for your age?

Table of Content :

| ↴ Is Final Expense Insurance right for you? | ↴Final expense life Insurance for seniors? |

| ↴ Who needs Funeral Insurance? | ↴What is Final Expense Insurance |

| ↴ What End-of-life insurance provides you with? | ↴ Final Expense Plan feature? |

| ↴ How much does the Final expense insurance program cost? | ↴ Essential Characteristics of` Final Life Expense insurance? |

| ↴ Why do people Choose Final Expense insurance ? | ↴ Get the Final Expense insurance insurance Quote Online ? |

No one likes to think about their death, but the bitter truth is that funerals are not cheap, varying between thousands of dollars based on circumstances and personal preferences. The price of laying our loved ones to rest rises every year, with the median cost having risen by nearly a third in the past decade.

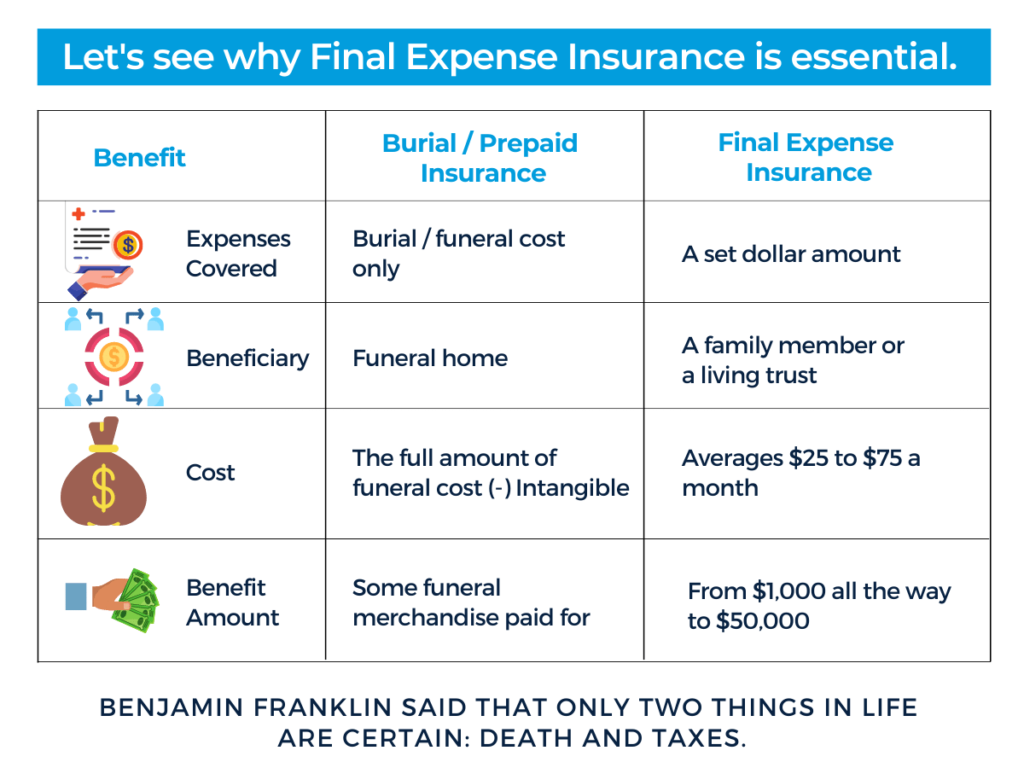

Benjamin Franklin said that only two things in life are certain: death and taxes. Franklin’s famous quote reveals a fact that is often overlooked in our time. This is the full content of the rich tapestry of life.

Funeral Insurance is usually a whole life insurance policy. It must be noted that funeral insurance is often referred to as

- Final Expense Insurance

- Senior Care Life Insurance

Is Final Expense Insurance right for you?

The final cost may be challenging to talk about. Preparing Final Expense Insurance is the best way to ensure that your family will not have to use their savings to pay for funeral and medical expenses that may be left behind. Almost anyone can benefit from the Final Expense life Insurance program. Individuals might find this type of insurance particularly beneficial based on:

- Needs

- Insurability

- Cost

You may select any of the following as beneficiaries:

- Children (step or adopted are acceptable)

- Spouse

- Parent (step is acceptable)

- Niece or nephew

- Cousin

- Sibling

- Family friend

- Grandchildren

- Great-grandchildren

- Aunt or Uncle

- Funeral home

The Senior Care Plan, we are proud of our history of building long-term relationships with our customers. The only way we can do this is to do business with our customers most honestly and transparently.

The Senior Care Plan Insurance Agency is not restricted by specific companies nor has special contracts.

Another important thing you need to know is that The Senior Care Plan Insurance Agency works with more than 30 top operators in the industry with A-level standards. We have a quotation engine, and we operate according to the results it produces. After customers choose an insurance policy, we will respect their choice unless we are asked our opinion or see another specific company offering something that may interest customers’ additional benefits.

Final expense life Insurance for seniors:

Since the final cost of life insurance is meager and there is no medical examination, this type of insurance is suitable for seniors who no longer need life insurance to replace income. Since the final cost of life insurance can be effectively maintained to 100 or even higher, Final Expense Insurance is the best choice for the elderly!

Who needs Funeral Insurance?

Final Expense Insurance is best for candidates including:

- Individuals over a certain age

- Individuals with severe health conditions

- Individuals with low income (or no income) and no assets

- Health conditions that make final expense insurance a more suitable coverage include diseases such as:

- Cancer

- HIV

- Parkinson’s disease

Many people have shown a preference towards the Final Expense Insurance Programs. These are intended to cover the funeral expenses of the deceased. Instead of leaving any excess money for the deceased’s relatives. The Final Expense Insurance aims to reduce the burden of all death-related expenses.

What is Final Expense Insurance?

Final Expense Insurance is a whole life insurance plan designed to cover all the medical and funeral expenses for the person once they pass away. The final expense insurance policy is also called funeral or funeral insurance and is highly sought-after for senior citizens. It is easier to obtain the approval of the final expense insurance policy program compared to other life insurance programs.

What End-of-life insurance provides you with?

- Final medical expenses

- Funeral expenses; funeral plans, funeral services, etc.

- Memorial service-oriented expenses

- Burial costs

- Home ceremonial hall fee

- Cremation costs/Anti-corrosion costs

- Coffins, urns, etc.

Final expense plan Features:

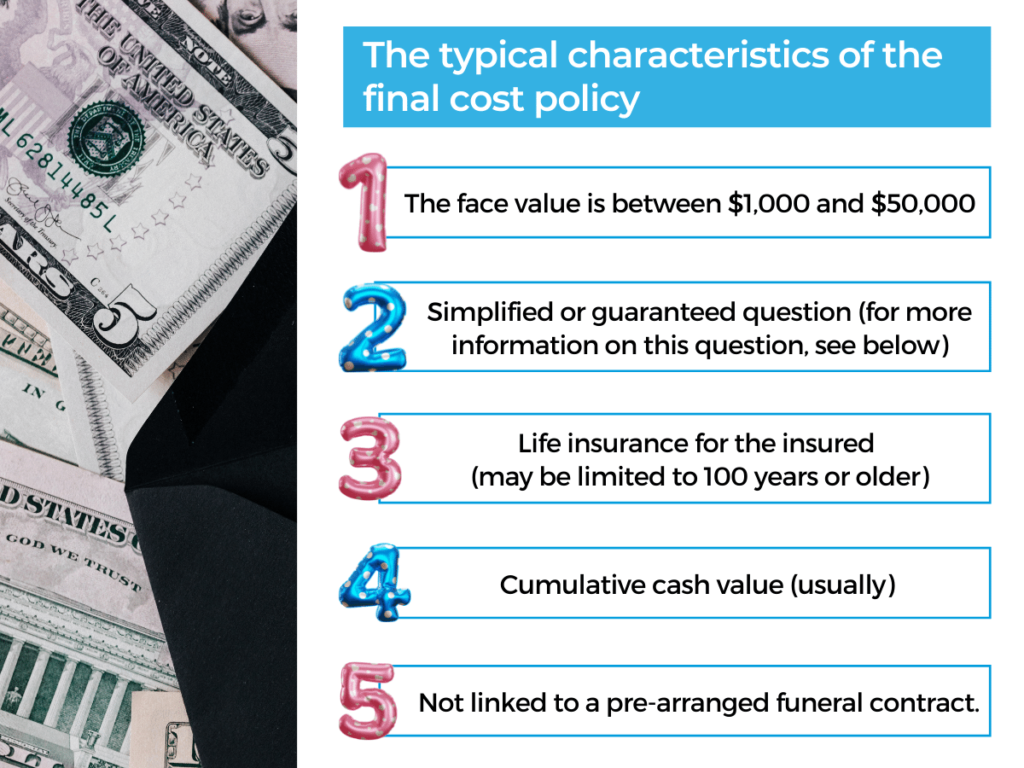

Most final expense plans have the following features:

- Whole life insurance – if the premium has been paid, then it will not expire.

- The cash value – the insured may be able to obtain a policy loan to pay a fixed premium.

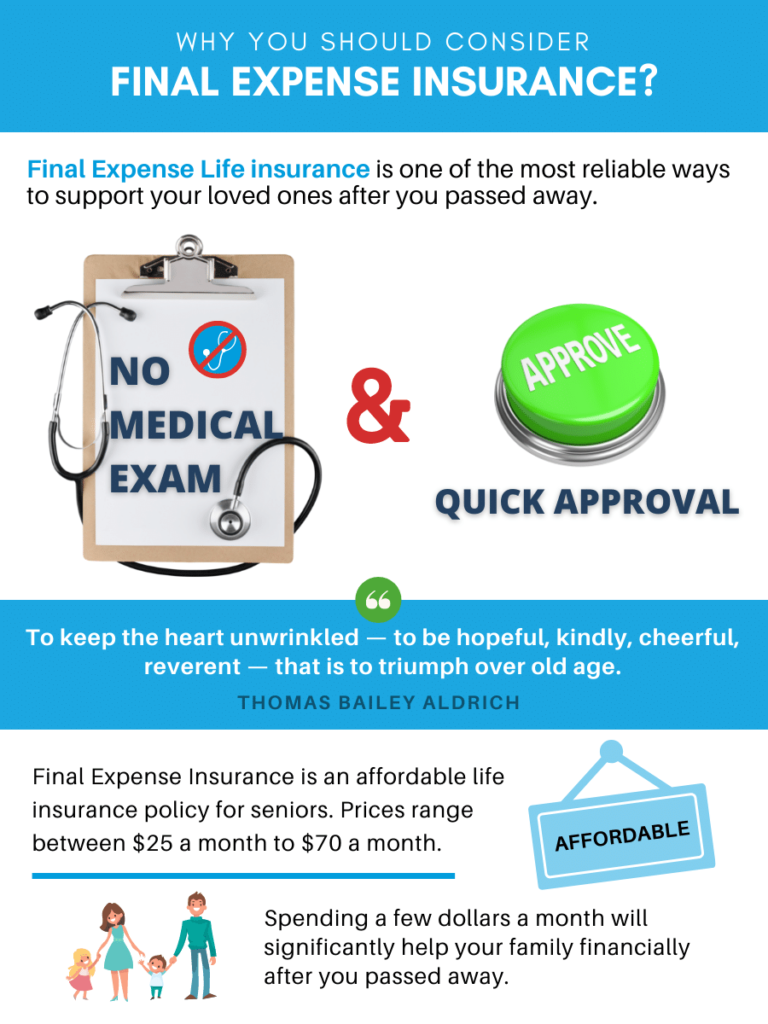

- Simplified questions usually require no medical examination (also known as life insurance test); health-oriented insurance testimonials are recorded through the application form; simple application procedure.

- Fast approval – coverage is usually released within a few days.

- Affordable price – The price does not increase with age.

How much does the Final Expense Insurance Program cost?

The average final expense policy costs depend on your:

- Age

- Sex

- Health

- Amount of coverage

- The life insurance company you choose.

The average final expense policy costs between $30-$70 a month.

70 years old?

If you have a severe health condition or are over 70 years old, your premium may be higher, and the monthly cost may be between $70-$120 (although it may be less).

Note:

Remember, affordable prices usually mean functions and benefits for the surviving relatives. Cost is typically the number one factor people pay attention to…, but it is not the most essential factor! Rather than looking at the cost of the insurance policy, it is better to pay attention to the expenses and how much they will cost your family.

Common fees include:

- Medical bills

- Credit card debt

- Funeral costs

What is the Final Cost of Funeral Insurance?

The following statements fully explain how they work:

- The fixed monthly payment for life.

- The policy cannot expire at any age.

- Death protection will never decrease a cash value that can be borrowed from it.

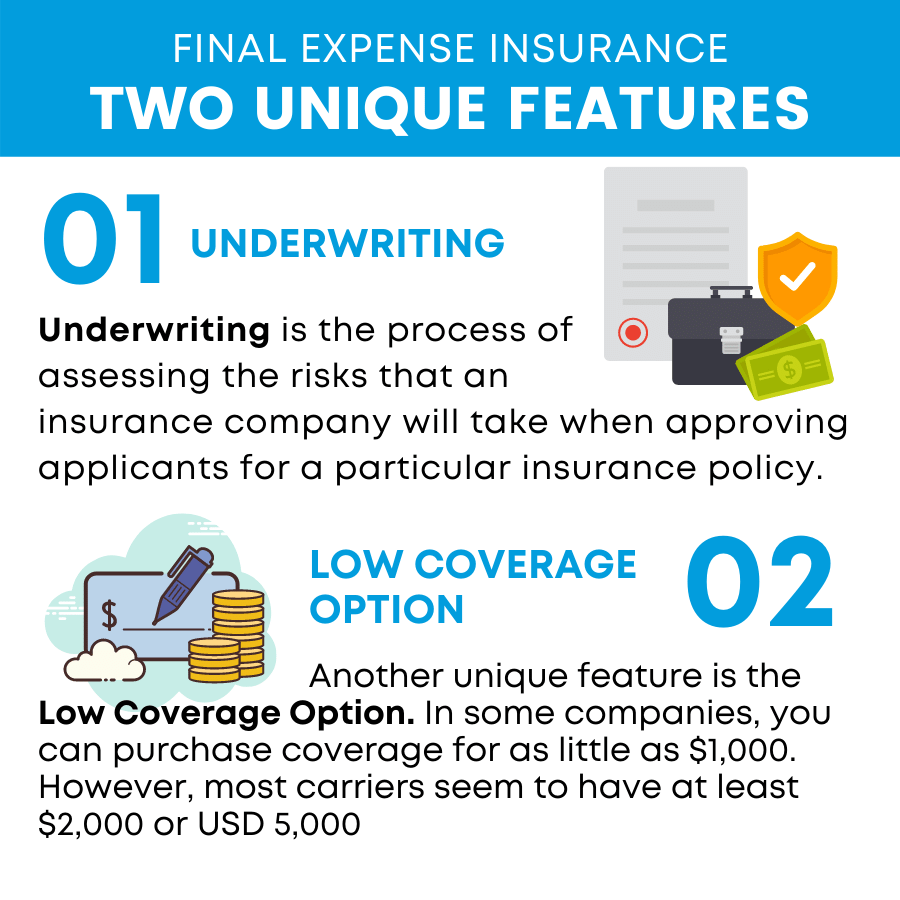

Two Unique Features of Final Expense Insurance

- Underwriting the process of assessing the risks that an insurance company will take when approving applicants for a particular insurance policy. Some policies require extensive evaluation of risk factors, including medical examinations and laboratory work, while other policies do not require any such evaluation.

Insurance companies have formulated these insurance policies to absorb the risks of certain serious diseases. This is great because it means that despite some significant health issues, you can still qualify!

2. Another unique feature is the Low Coverage Option. In some companies, you can purchase coverage for as little as $1,000. However, most carriers seem to have at least $2,000 or USD 5,000.

Essentially, once the insured person dies, the insurance company will pay the beneficiary all death pension taxes free of charge. This gives your loved ones money to pay the final cost. If there is money left after paying the funeral expenses, the money will remain in the beneficiary’s hands.

You may select any of the following as beneficiaries:

- Children (step or adopted are acceptable)

- Spouse

- Parent (step is acceptable)

- Niece or nephew

- Cousin

- Sibling

- Family friend

- Grandchildren

- Great-grandchildren

- Aunt or Uncle

- Funeral home

The funeral insurance policy will never require you to undergo an examination or provide medical records as part of the application. You only need to answer some questions about your health.

Why do people choose Final Expense Insurance?

From burial expenses to medical expenses, the days, weeks, and months after death are stressful periods for family and friends. For individuals who want to reduce the burden and help ensure that their loved one does not have out-of-pocket expenses related to hospice care, funeral expenses, and/or outstanding debts, Thescplan provides affordable final expense insurance for individuals aged 50-85 Amount from $1000 to $50,000.

The Senior Care plan – offers two final expense products, namely preferred level, and guarantee issuance. Both are permanent lifetime products, which means they will take effect as long as you pay the premium. They all provide the accumulation of cash value. When choosing any product, no medical examination is required to obtain instant approval.

Sampling Rate Below is some examples of monthly expenses for senior citizens. As you can see, the rates increase significantly with age. Most older adults will get insurance as soon as possible to lock in a lower rate.

Get the Final Expense Insurance quote online:

Insurance rates are constantly changing to reflect new mortality rates within each demographic. Each final expense company sets its speed based on underwriting standards and actuarial data. The most affordable policy of one company may not be the most affordable policy of another company. The best way to determine which approach is best for you is to talk to an authorized agent who can provide you with a free quote that meets your specific needs. There are many final cost plans,

These are essential questions to consider before choosing a service provider, especially when protecting your family during the funeral process.

- Which one is best for you?

- Which one can best protect your family?

- Which can pay your claim the fastest?

- Which one will help your family’s funeral arrangements?

Conclusion:

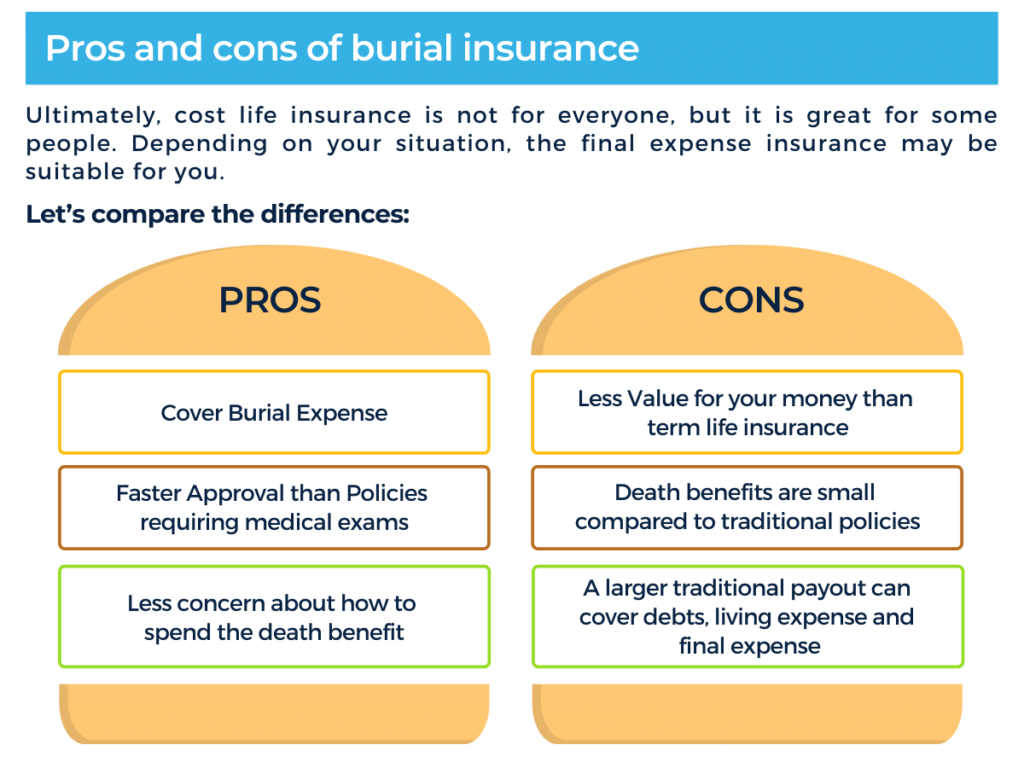

The final cost of life insurance starts at approximately US$20 per month, although the rate depends on your age and the death benefit provided by the policy. If you want to get the most value in terms of final cost life insurance, then the best option is to shop around until you find the lowest monthly or annual cost policy in a reputable company. To develop some examples as a basis for comparison, you can use The Senior Care Plan Final Expenses Insurance website to get an online quote for a typical 65-year-old retired woman in good health.

Like other types of life insurance, the final expense insurance will pay your beneficiaries a death pension, and they will get this benefit all at once. This means that your beneficiaries can choose to use the policy proceeds. That being said, the ultimate expense life insurance is designed to cover (you guessed it) the maximum expense. This may include:

- The cost of funeral and burial

- The cost of liquidating property

- The cost of living at the end of life

Families also use end-of-life insurance to cover expenses that you might not even think of in advance, such as:

- Flowers

- Obituaries in newspapers

- Even unpaid medical or credit card bills

Although your heirs can still pay for the service in cash and wait for the final expense policy to be paid, they can even assign the final expense life insurance policy directly to the funeral museum if your heirs choose to use a life insurance policy to pay for a ceremonial hall directly.

faq

Final Expense Life Insurance FAQs:

Final expense policies are a type of permanent life insurance with a lower death benefit intended to pay for expenses at the end of life. There are two types: guaranteed issue and simplified issue.

Premiums vary by age and provider, but you’ll pay more for final expense insurance than a standard term policy. Final expense policies are whole life. This means that for as long as the policy is enforced, the likelihood of the carrier paying the claim is very likely as opposed to a term life insurance there’s a high likelihood that the insured will outlive the term of the policy, and this is the reason there’s a difference in cost between the two policies.

Final expense insurance is best for

- Older applicants with serious health problems. The payment can be used for final medical and funeral expenses.

- Young individuals who would like to secure their rate at a young age and design the policy with a payout of 10 years and be done with their payments