Written By MaryJane Nwansi

Burial insurance is a type of whole life insurance that is designed for seniors who want to spare their family the cost of funeral expenses when they are gone. While its name might suggest otherwise, burial insurance can also be used to settle off medical bills, card debts, mortgage loans, and other expenses accrued by the deceased.

In this article, you can expect to find everything you need to know concerning purchasing a burial insurance for yourself, friend or a loved one. You’ll also learn;

- What a final expense insurance is all about and everything it covers.

- Who is eligible for a final expense insurance policy.

- Benefits of a burial insurance and why you need it

- The future of burial insurance policies and why you should get insured now.

- How much burial insurance coverage you need, and more!

Table of Content :

| ↴Burial Insurance: What is it? | ↴What are the Benefits of Buying a Burial Insurance Policy? |

| ↴Who is Eligible for Final Expense Insurance? | ↴Who Needs Burial Insurance? |

| ↴Why Do I Need Burial Insurance? | ↴Types of Burial Insurance Policies |

| ↴How Much Burial Insurance Coverage Should I Buy? | ↴Is There an Age Limit for Buying Life Insurance? |

| ↴Policies to Avoid at all Cost | ↴How Often Should I Have My Life Insurance Reviewed? |

| ↴Conclusion | ↴FAQs |

Burial Insurance: What is it?

Burial insurance can also be called “ Funeral Insurance” or “ Final Expense Life insurance”. It is a type of whole life insurance policy designed for senior from the ages of 50, and above, but it could also be sold to younger individuals, even children! Since the policies are smaller than regular life insurance, the premiums are way less. The coverage is anywhere from $1000-$50,000, depending on your location, burial service cost, the cost of a casket, burial plot, and more.

Funeral insurance is easy to obtain and doesn’t require any long or grueling process. You do not even have to worry about going through a medical exam. In some cases, all you need to do to qualify is answer some questions relating to your health in the application form, as honestly as possible, and that’s that!

Death, illness, and old age are inevitable, so it is wise to plan ahead to spare your loved ones large expenses when you are gone. It also ensures that your final wishes are met, and things go the way you would want them.

What are the Benefits of Buying a Burial Insurance Policy?

You already know that the burial insurance policy protects your loved ones from financial burdens and debt when you are gone, but it isn’t just that. The burial insurance policy protects you too. Listed below are a few benefits to the burial insurance policy;

Easy To get

You can get a burial insurance policy at home without undergoing any medical examination. Just do some research, get a quote from different companies and agents, and find the plan that best suits your needs. Here at thescplan.com, we can help you make your decision easier. In The Ultimate Guide to Burial Insurance For Seniors, you were learned that all applicants are asked for their;

- Age

- Health Conditions

- List of prescription medication

- Use of tobacco

Purchasing a Burial Insurance Policy Online

First, let me tell you this, purchasing an insurance policy online is easier than you can imagine. I have outlined seven straightforward steps that you can follow to get insured today, and they are;

- Compare Different Insurance Plans Online: There are many insurance companies online that offer free quotes for people like you who are still in the research phase and are unsure of where to start or which company to purchase a policy from. You can check as many sites as you want and compare plans. Don’t forget to make sure these sites are authentic and make sure they have an outstanding reputation and amazing online reviews.

- Choose The Plans That Best Suits Your Needs: Nobody knows what you want better than you. When choosing the best plan for your needs, make sure you consider affordability. Always choose a plan that you can afford in your current situation, and also consider the type of premiums you would pay i.e stepped premiums which are premiums that increase as you age, or level premiums that remain fixed over time. Most importantly, determine if the plan you choose would be enough to cover all your final expenses.

- Speak To an Agent For Questions: Different independent agents work with different insurance companies, and exclusive agents who work for only one insurer, so if you have any questions or need any suggestions, just contact them and they’ll surely help.

- Submit The Application: This is actually the easiest part, all you need to do is fill in your personal information, and in some cases answer some health questions on the application form, and voila!

- Wait For Approval: The good news is, approval is almost certain. Burial insurance isn’t like traditional life insurance that requires a medical exam and a long waiting period. Underwriting can even be done within a few days! That’s faster than any other insurance policy.

- Make Your First Monthly Payment: Once you are approved, you can pay your first premium, which will be the first of many.

- Receive Your Policy: Congratulations! You are insured. Once you’ve paid your first premium, you receive your policy and are officially insured.

Affordable

Burial insurance costs less than traditional life insurance, with affordable monthly premiums that would depend on your age, sex, and health condition. Burial insurance policies can be purchased for small amounts, ranging from $1000 to $50,000, accidental death benefits may be included as additional coverage in many cases the death benefit doubles.

Ease and Speed

After applying, you can get approved on the same day or within just a few days, as opposed to a 30-60-day waiting period for traditional life insurance policies.

- There are no medical exams or lab tests involved.

- Underwriters assess the risk being taken quickly because the coverage amount for burial insurance policies isn’t as high as traditional life insurance policies. They’ll check your prescription records, and in some cases, your criminal record. Once they are done with their “investigation”, they’ll assign you a rating, which could be;

- Preferred Plus: this is rating you get if you are in sound health, have no prior health history or condition that may put you at risk in the future, have a good family medical record (i.e no history of inherited diseases or illnesses), and have a normal weight-height ratio. Note that you might not be considered for a preferred plus rating if you have a high-risk job or engage in activities that could potentially risk your life. Since this rating basically gives you the all-clear, it is less expensive than the rest.

- Preferred: The standard rating class is issued to people who have an average mortality risk or an average life expectancy.

- Standard: This rating is for people who have certain risks. Such as people with high cholesterol levels, high blood pressure, and other non-chronic health conditions. Also, smokers, or people who are slightly overweight. People with other health conditions would also be considered mainly if their condition is not chronic.

- Substandard: the substandard rating class is for people who are at higher health risk. You’ll get rated if you have a high-risk job, life-threatening or fatal medical condition (e.g cancer), complicated family medical history, or drinker. Also, if there’s a criminal record history or practice a risky hobby such as rock climbing and the sort.

Safe and Predictable

If you work closely with a certified agent, the process is pretty straightforward.

- You get guaranteed fixed, budget-friendly life insurance.

- You remain covered for as long as you pay your premiums.

- Payment processes aren’t stressful. You can pay with your checking account, annual direct payments, or in most cases, through social security benefits.

- Your burial insurance policy would be issued by highly rated carriers so that you have nothing to worry about, and are kept up to date about your coverage.

Flexible Coverage

You get;

- Tax-free death pension for beneficiaries

- Permanent coverage for low monthly premiums, depending on age, sex, and health.

- Over time, you can request loans from your burial insurance (with 5-10% interest) which will affect the total balance due from your death benefit if not paid back.

The Most Important Thing You Can Do For Your Family

Every person from the age of fifty should think about getting a burial insurance policy. It is the best and most important financial decision you would make. You do not have to wait until you retire before making this decision. Death is not something that is planned in any circumstance, but it is something that can be planned for. When you are gone, your loved ones might be overwhelmed with grief, but if no financial plan has been put in place for the funeral, they may be destabilized, emotionally and financially.

Burial Insurance for seniors is a wise choice, not an omen of bad news. In recent years, the cost of funerals has increased considerably, ranging from $5000 to $25,000, depending on location, choice of burial, and more. So, why not prepare now? If you know exactly what you want to be done in your last days, prepare for it! It is the best thing you can do for yourself and your family.

No Long Process To Qualify For The Policy

In recent times, Insurance companies have developed products to suit the needs of the average people and the elderly, especially with an aging population. These are usually medium value whole-life insurance policies with death benefits between $2000 and $50,000

Other Benefits Include;

- You get to choose your beneficiary during the application process so that you do not have to worry about who your money goes to when the time comes.

- Beneficiaries can be removed and replaced at any time while the policy is active.

- Cost-Friendly; generally a $10,000 standard rated for 50-year-old male costs an average of less than $2 a day.

- The total value of the policy is paid to beneficiaries at the death of the insured if the policy was standard or preferred rated.

Who is Eligible for Final Expense Insurance?

Anyone between the ages of 50 and 85, with or without a history of any health condition can qualify.

Anyone looking for under $50,000 in coverage. This is why it isn’t a traditional life insurance policy.

Who is eligible for funeral insurance without medical examination?

Anyone from ages 50 to 85 can enjoy funeral insurance without a medical examination. Even those with pre-existing illnesses or people denied elsewhere or those considered high risk are eligible for funeral insurance without a medical examination. The only illnesses that make you ineligible for this type of insurance are AIDs, having a terminal illness, or being in a nursing home facility.

Who Needs Burial Insurance?

Burial Insurance is generally recommended for;

- Candidates who aren’t considered eligible for traditional life insurance coverage.

- People who have suffered or are suffering severe illnesses.

- People over a certain age, generally over 80.

- People who have no assets, or have low (or no) income.

- People who are NOT financially responsible for others (if the person dies, no one will be affected if their income stops).

You may wonder, what type of diagnosed illnesses make final expense insurance a better choice? Well, chronic illnesses like HIV, cancer, Parkinson’s disease amongst others. For most other diseases and higher than $50,000 in coverage, traditional life insurance is more profitable.

What Does The Final Expense Insurance Cover?

The final Expense insurance covers the following;

- It offers you the security of guaranteed death benefits.

- Money to use towards funeral and burial costs.

- The final expense insurance is eligible to earn dividends, although this may vary per insurance company and is not guaranteed.

- You have the liberty of choosing between a monthly or annual premium plan.

- Other end-of-life expenses would be paid off with the money left over after the funeral cost has been covered.

- The cash value and benefit pay-out are tax-free.

- Premiums are payable to the age of 120 and are guaranteed not to increase.

- Your chosen beneficiary has the choice to use the pay-out for anything other than burial expenses.

- Some Final expense policies include other riders (i.e additional benefits) such as funeral merchandise discount, additional coverage if the insured dies from an accident, a critical illness, prescription discount cards, and more.

Why Do I Need Burial Insurance?

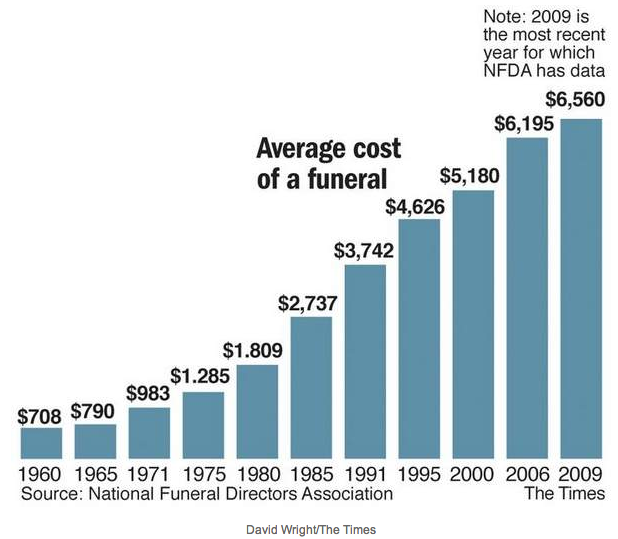

The chart above shows that funeral cost has been on a steady rise since 1960, now funerals cost anywhere from $5000 to $20, 000 which is over a 50% marked increase in the last ten years, what’s to say it wouldn’t increase by another 50% in the next ten years?

According to the National Association of Funeral Directors (NFDA), the average cost of funerals will increase in the next couple of years. According to a recent cremation and Burial report they conducted, cremation rates could soar to 78.4% in 2040, while coffin funerals will cover 16% of the death toll in the United States.

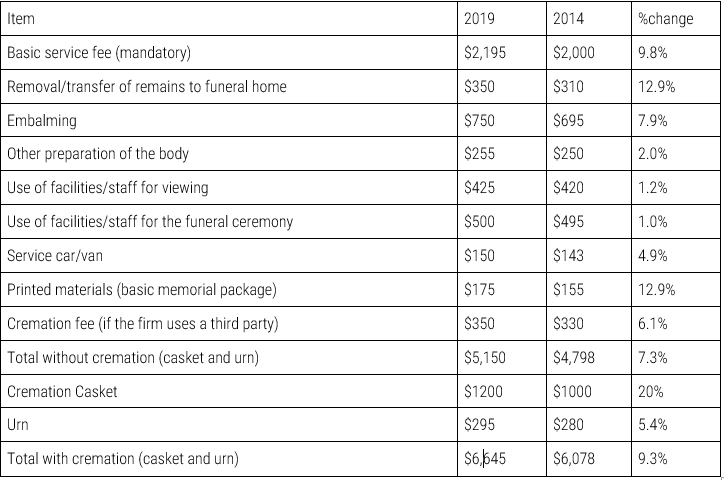

Not many people understand the cost involved in planning a burial, So let’s look at a comprehensive list of expenses in real-time. This data was compiled by the NFDA and includes the median increase of funeral expenses in 2019.

Funeral services can further be broken down into two types;

- Traditional burials

- Funerals with cremation

Traditional Burials (Price List)

- Metal casket: $2,400

- Basic services fee: $2,100

- Vault:$1,395

- Embalming: $725

- Facilities/staff for ceremony: $500

- Facilities/staff for viewing: $425

- Hearse: $325

- Removal or transfer of remains: $325

- Miscellaneous preparation: $250

- Printing of Memorial: $160

- Service vehicle(s): $150

Funeral With Cremation (Price List)

- Basic services fee: $2100

- Cremation Casket: $1000

- Embalming: $725

- Facilities/staff for ceremony: $500

- Facilities/staff for viewing: $425

- Third-party cremation fee: $350

- Removal or transfer of remains: $325

- Urn: $275

- Miscellaneous preparation: $250

- Printing for memorial: $160

- Service vehicle(s): $150

Future Scope of Burial Insurance Policies

We are all aware of how much the pandemic affected the health sector, and the extent of its damage couldn’t have been predicted. So, burial insurance policies have had to be modified to fit the drastic risk to people’s health. The coronavirus is something that many people didn’t expect and weren’t prepared for. Seniors who had gotten burial insurance would be glad they did so because they are more vulnerable to this virus than the younger and fit population. So, it is evident that the future of burial insurance policies isn’t fixed and is inclined to grow.

With the increase in death rates due to the pandemic and the steady increase in funeral expenses, low-income individuals and families are facing difficulties. That is why burial insurance for seniors has been made affordable because many seniors and retirees have fixed incomes and low monthly budgets.

The increased mortality rate in the US due to the pandemic has increased the demand for burial insurance, especially for seniors, and it is a fundamental economic principle that when demand exceeds supply, an increase in cost is expected. So, funeral costs will definitely increase in the coming years, especially if the pandemic becomes a norm. Precisely why it is advised that you get insured now. Life isn’t guaranteed and it became more evident with our current state of health crisis throughout the world.

Types of Burial Insurance Policies

There are three main types of burial insurance and they are as follows;

- Prepaid Planning

- Final Expense or Burial

- Traditional Life Insurance

Prepaid Planning

Prepaid planning can also be referred to as a “pre-need funeral plan” and it generally refers to insurance services or coverages that have been paid for in advance by the insured. If the coverage is still active and hasn’t been used up, it will appear on your insurance company’s balance sheet as a current asset. This means, cash or cash equivalent, that is expected to last a year. The pre-need funeral plan is expected to cover burial or funeral-related expenses as previously selected and stipulated in the contract by the insured while alive.

Pre-need and Prepaid Plan; What You Need To Know

- You can pay without using a payment plan, meaning you can pay the lump sum (total value of insurance plan) instead of paying monthly premiums.

- The Plan would include guaranteed and non-guaranteed sections.

- The guaranteed items are usually the merchandise such as: casket or urn, vault etc.

- The non-guaranteed are the services which are non-tangible, such as funeral services, the religious ceremony etc (there’s normally an amount of money set aside for these services with no inflation clause for protection.

- All costs will be determined by the funeral home of choice

- You can plan the whole burial or funeral service just as you would want it, so that loved ones can be happy and be at peace when you are gone.

- The plan you opt for might no longer be available at the time of your death, and according to Allied Market research, at least eighty percent of families end up paying 30% of the total funeral cost due to a shortage of coverage. This is due to the increased cost of funerals over time, which your prepaid plan might not be able to cover.

- The plan is usually locked to a location or several (within the funeral’s network). They are normally not transferable nor liquidable.

Final Expense Insurance

Final Expense Insurance can also be called “funeral insurance” and refers to smaller permanent life insurance policies that are designed to help seniors settle funeral or final-life expenses.

Final Expense Insurance: What You Need To Know

- The benefits aren’t limited or defined for a specific funeral home.

- Your chosen beneficiary receives the money when you pass

- Most financial planners would suggest a $25, 000 insurance plan in case of inflation in later years

- It can be purchased from most life insurance companies online and offline.

Types Of Final Expense Insurance

- Guaranteed Issue Life Insurance-also called “guaranteed acceptance” or, “no questions asked like insurance”, is a type of whole life insurance policy that does not require you to undergo any type of medical exam or answer any health-related questions. As the name implies, it is a type of insurance that you are guaranteed to get, but there is a catch. While it might seem like a fitting option for most people, it has a waiting period of two, or in some cases three years.

So, if anything happens to you during the waiting period, your beneficiaries will NOT receive the insurance policy’s death benefit, which refers to the payout of the insurance policy to the aforementioned beneficiary when the insured dies. This is in no way an attempt to rip you off, all premiums paid will be paid out to the beneficiary, usually with an interest of 5-10%. This clause is put in place to protect the company since almost anyone is eligible for the insurance, including those with chronic illness.

- Simplified Issue Life Insurance- this type of insurance is the type that you can get with little to no health questions, and is designed for those who need health insurance immediately or those who do not want or are unable to answer health questions.

Traditional Life Insurance

A traditional life insurance policy is an insurance policy that is designed to cover the insured for larger amounts of money. It could be done with term life, universal life, whole life. So, this is usually recommended at the earlier years of one’s life, and with a coverage plan of 10-25 times of one’s current income. So, upon the inevitable death of the insured, the insurance payout is sent to the beneficiaries listed in the insured’s contract. Most insurance companies would include a withdrawal clause in the contract for those who opted for universal life or whole life, which would cancel your coverage if you choose to, and you’d get a cash surrender value (total premiums paid minus a surrender charge, in fixed sum or percentage).

There is also a cash grown component inside your permanent life insurance policy (if you choose whole life, or in most universal life insurance policies). This is a feature in traditional life insurance policies (except for term life) that allows you to borrow from the cash accumulated inside your insurance policy, to be recovered by the insurance company at the payout time, which would inadvertently decrease your insurance payout. Think of it as a non-regular bank loan. So, when the insurance company deducts the amount owed from the face amount at the time of the claim, you pay back with the calculated interest. You benefit because the returns are still yours.

Other Features to Note;

- It isn’t limited to funeral or burial expenses

- The chosen beneficiary receives the policy payout

- The recommended life insurance plan is usually 10-20 times your current income as it runs throughout your life.

- It is a better choice if you are looking to pay off large expenses like your mortgage.

- It is cheaper and easier to buy in your golden income years

- Can be obtained from 90% insurance companies, online or offline.

Some seniors would consider life insurance to protect their reverse mortgage loan. Not necessarily their funeral costs, but because they are looking to get a reverse mortgage, and need insurance coverage for the total amount of the loan, plus the estimated compound interest. If that is the case, then they’ll require a much larger policy which would be a traditional life insurance policy, and a separate final life insurance expense policy to keep burial expenses separate from the reverse mortgage expenses. Speak to one of our specialists if this is your case.

How Much Burial Insurance Coverage Should I Buy?

First of all, it is worthy of note that there isn’t any fixed price for burial insurance. Just get what you can afford. Many seniors have fixed incomes and pensions, and cannot afford to go over their budgets, and that’s fine! Just let your insurance agent know how much you can afford to pay, and they’ll guide you accordingly. The average premium costs 60-70 dollars per month which is more than affordable on an average budget. There are a few things to note before you choose insurance coverage and they are;

- You can purchase multiple final expense contracts throughout your life. For example, if you can only afford a $5000 policy today, at your current age, and in three years you can afford to purchase more? You can! It doesn’t even have to be from the same carrier, no matter the health changes or circumstances (You’ll be issued a class rating at the current time of purchase).

- Companies will ask for all your existing policies , and if you are “over insured”, they might wonder if you are training to end your life soon, this would only be the case if the value of your total combined policies is extremely high in comparison to your income.

- The total cost will depend on the kind of funeral you want, and according to the national funeral association, the median cost of a national funeral is anywhere from $8,000 to $10,000. This does not include the cost of cremation fees or flowers, markings, cemeteries, obituaries, music, video or death certificates.

- To get the final expense, you’ll need to add $7,500 for family expenses with the above-listed burial expense, which should make your total expense approximately $20,000.

- Take into account possible inflation in the coming years. So, you’ll multiply the total above by the inflation rate.

Is There an Age Limit for Buying Life Insurance?

Burial insurance is better suited for people between the ages of 50 t0 85, although there are some companies that provide insurance for people as young as forty five years old. Burial insurance does not expire and will cover until the age 120, but is considered paid off at age 100 since most people do not live longer than that. After all, the current average life expectancy rate in the US is 78.99.

Some insurance companies even offer funeral insurance from birth up until the age of 85, while others start at the age of 45 up to the age of 85 to 90. As you grow older the maximum death benefit you are allowed to choose decreases. So, if you are 70 or younger, you can choose a policy of $50, 000, or $25, 000 if you are above 70.

Policies to Avoid at all Cost

The first thing you should do when seeking an insurance policy to buy is to check the fine print at the end of each final expense life insurance TV commercial. Many of these burial insurance programs hide the finer details that might make them attractive, and potentially problematic to you. Before agreeing to any type of insurance policy, read through the policy contract and make sure you understand what it entails before you sign.

You should also watch out for “no questions asked life insurance products”. Do not mistake me, what we spoke about earlier in this article is “No medical questions asked”. Good insurance companies and agents will require personal details like your age, sex, and beneficiary information to give a package that suits you and meets your needs. No good insurance program will give you access to an insurance policy with no questions asked.

There are numerous “no questions asked insurance programs” available these days, and they give tempting offers that you might eventually fall for. They offer;

- Same day approval life insurance

- FREE Life Insurance

- Everyone is eligible for coverage

- $1 per day life insurance

Perfect for anybody, right? Not quite. They offer temporary coverage, meaning that the policy will only be active until a certain age, say 80, and then expire. And when you read the finer details, you’ll find that NONE of these programs offer first-day full-day coverage for natural causes of death. Many will only cover for accidental death only. Remember, be careful, and READ THE FINE PRINT.

How Often Should I Have My Life Insurance Reviewed?

- You have adequate coverage (you might want to take on some more).

- Review if you want the same beneficiary or if you want to add or replace some.

- Check to see if the payout option is still available to you

- Check your cash value growth.

- Review your address and make appropriate changes if you have relocated.

Conclusion

Final expense or burial insurance is a moderate or fair choice for the average person or those with low income. It is a way of securing the future for yourself and your loved ones so that they do not incur debts when you pass. This insurance plan is for seniors who want to happily spend the rest of their days, knowing that their final expenses are settled.

It is a permanent whole life policy with no grueling registration process, medical examinations, and little to no health questions. You will get approved within days of applying without the lagging 30-60 turnaround time of a traditional life insurance policy. Some insurance companies do not provide coverage for seniors over the age of 89, while some have come forward with insurance coverage plans for seniors over the age of 90. It is recommended that you review your insurance policy at least once every year so that adjustments can be made if you require them.

Although the final expense insurance is sold to seniors to cover funeral expenses, the proceeds can be used by the beneficiary for whatever they may choose, which could include medical bills, card debts, and more.

Allied market research has recently given us a glimpse of what the burial insurance policy could look like in the future through a detailed report. According to this report, funeral expenses are expected to increase in the coming years due to the steady growth of the funeral insurance market. Also, the global effect of the pandemic has caused an increase in mortality rate, which has increased the demand for funeral insurance.

In short, we advise that you make hay while the sun shines. Anything can happen, so pay for burial insurance while you can afford to. When your loved ones should be grieving isn’t the right time to leave them with extra financial burdens. Leave in peace so that they may remember you fondly.

faq

Final Expense Life Insurance FAQs:

Final expense insurance is a type of whole life insurance policy that is meant to cover funeral costs and other end-of-life expenses. Approval is easy and stress free. There are three approval ratings with these policies, and they are as follows;

- Standard = no waiting period

- Simplified Issue 24 month waiting period

- Guaranteed Issue = 24-36 month waiting period

The monthly premiums you get will vary by age, sex, smoker rate and the insurance company used. But it will cost more for the final expense insurance policy than the traditional insurance policy. This is because policies are charged per unit cost, based on the amount of risk the companies take. Even though traditional whole life, as well as final expense life are both whole life insurance policies, the only difference is that one has a lower limit of coverage while the other has higher. The biggest factor that makes traditional whole life insurance less expensive per unit cost is that they go through a more extensive underwriting. They do a more thorough questioning and run multiple reports on the applicant. If the person is healthy, then the insurers save money, if not it will cost them more.

Final expense insurance is most suitable and recommended for ;

- Adults over the age of 50 with no dependents

- Single individuals

- Individuals over 85

- Individuals that might be moving out of state or country in their life retirement years

- Individuals that have been denied traditional life insurance